Fascination About Zillow Home Loans

1910 Foursquare In Saint Louis Missouri — Captivating Houses

Not known Details About Zillow Group, Inc(Z) Stock Price Today, Quote & News

"The Q1 resale velocity, in which 128 percent of starting inventory was offered throughout the quarter, was ahead of strategy," Barton wrote in a letter to shareholders. Zillow Provides generated $700. 9 million in income during the first quarter, down 9 percent. (Throughout I Found This Interesting , the company said it would start making deals based upon its Zestimate.) Overall, Zillow's Homes section, which likewise includes title and closing services, lost $58 million.

It notched 2. 5 billion gos to, up 19 percent from a year earlier. Although Zillow has the lion's share of customer eyeballs in the market, the property giant has actually been recasting itself over the previous 2 years into a one-stop-shop for genuine estate deals. It now uses home mortgage and title services, in addition to instant homebuying.

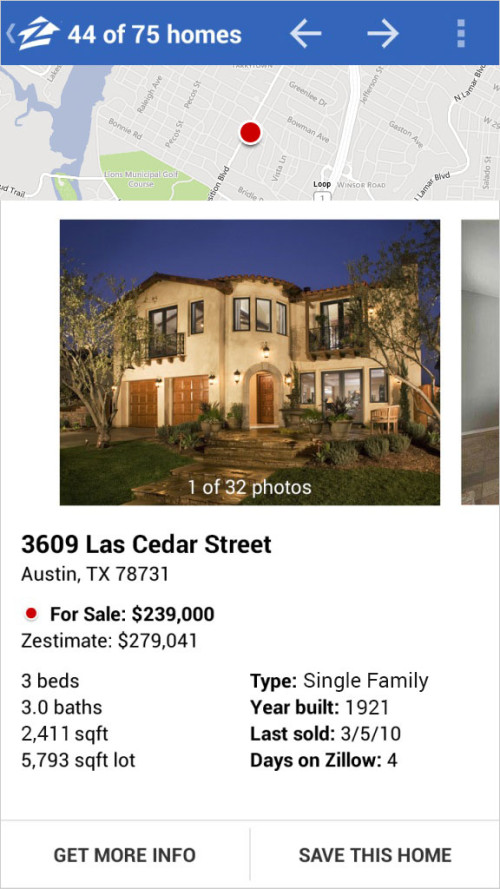

Phoenix Real Estate - Phoenix AZ Homes For Sale - Zillow

Zillow's mortgage service was another intense spot during the quarter. Home mortgage income rose 169 percent to $67. 9 million. The sector's bottom line was $2 million. Zillow finished the quarter with $4. 7 billion in cash and financial investments, up from $3. 9 billion at the end of in 2015.

Today, I cover (NASDAQ: ZG) (NASDAQ: Z), which numerous think about the finest of breed housing innovation business. Zillow completes against businesses such as (NASDAQ: RDFN) and (NASDAQ: OPEN). Is Zillow the (NASDAQ: AMZN) of real estate? The company's solution is called Zillow 2. 0, and its objective is to "develop a significantly simpler realty deal through innovation, service and combination." Today's customers want info at their fingertips, and they demand streamlined shopping experiences that utilize innovation.

The 2-Minute Rule for registration statement on Form S-1 - SEC.gov

Today's service environment is everything about speed and convenience, and customers leverage innovation from business such as (NASDAQ: NFLX), (NYSE: UBER), (NASDAQ: LYFT), (NASDAQ: GRUB), (NYSE: DASH), (NASDAQ: EXPE), (NASDAQ: ABNB), (NYSE: CVNA), and others to allow these experiences. Real estate is the next rational step in the worth chain, and Zillow is an early leader in this disruptive technology space.

22 billion in profits, and it was able to beat preliminary assistance in all sections. Maybe most excellent, Zillow Group reported an astonishing 169% year-over-year growth in its mortgage sector. This could certainly be a threat for banks and business such as (NYSE: RKT). One of Zillow's threats is its i, Buying sector.